The startup scene in India is flourishing. More than 110 unicorns and more than 1.25 lakh companies call India home, according to the latest data. Young founders, dazzling financing rounds, and product innovation are frequently the center of attention. Still, this ecosystem is also supported by a smaller but no less significant group: accountants, especially Gujarati accountants. In this article, we’ll examine the crucial yet often overlooked role Gujarati accountants play in supporting Indian businesses, what makes them unique in this regard, and why entrepreneurs should take notice.

The Gujarat startup context

First of all, it highlights the importance of Gujarat in the startup narrative. With more than 13,000 startups enrolled and 1,350+ startups receiving incubation support, the state has demonstrated a strong startup momentum. Gujarat’s robust industrial foundation, excellent connectivity, business-friendly laws, and entrepreneurial culture all contribute to the state’s ecosystem. To put it another way, Gujarat is more engaged in startups in addition to business.

Chartered accountants (CAs), financial experts, and tax specialists who are rooted in the area are familiar with the business culture and frequently work with startups in this context. Even while their work is fundamental, it might not garner much attention.

“Accountants may work in silence, but their numbers speak the language of Gujarat’s growth.”~ CA Mayank Sancheti

Why Gujarati accountants bring value to startups

Here are some of the specific ways in which accountants from Gujarat bring distinct value to startups:

a) Deep business-and-finance roots

Gujarat has a long tradition of trade, commerce, and small-scale entrepreneurship. This means that many accountants here are familiar not just with strict compliance rules but with the rhythms of business: cash flows, margins, fast turns, informal business practices. This practical business flavour helps when a startup needs to move fast, change direction, or manage lean operations.

b) Startup-friendly services and advisory support

Many accounting firms in Gujarat now offer services tailored for startups: company registration, bookkeeping, GST/ tax compliance, regulatory filings, funding readiness, etc. For example, firms such as those noted in Gujarat help startups with accounting & tax registration, compliance, and bookkeeping. This means a founder can tap into regionally grounded accounting services that understand the local market, state incentives, and practical challenges.

c) Local networks & cost efficiency

Because Gujarati accountants are embedded in the regional network, like local banks, state-level incentive programmes, mentoring groups, and industrial clusters, they can guide startups to useful local resources. Also, costs may be lower compared to large metropolitan firms. This cost-effectiveness is crucial for early-stage startups, which often operate under tight budgets.

d) Compliance + growth mindset

Startups often struggle with compliance because they are focused on product/market fit. Gujarati accountants who specialise in startups help balance the need for compliance (GST, tax audit, financial reporting) with the agility of growth (tracking burn rate, pivoting business models). They act as growth enablers while keeping the company on a solid financial footing.

The hidden but critical roles they play

Let’s look at specific roles that Gujarati accountants play for startups, roles that go beyond the traditional bookkeeping and tax-filing.

a) Early-stage structuring and incorporation

When a startup is formed, decisions like choosing the right legal entity (LLP-vs-Private Ltd), applying for startup recognition or tax incentives, registering for GST, etc matter a lot. Firms in Gujarat are supporting these early decisions. This foundation saves the startup headaches later.

b) Cash flow monitoring and burn-rate control

Many Indian startups fail for lack of proper cash management. Having an accountant who formats financial statements, sets up monthly monitoring, helps interpret financial data is a huge plus. Gujarati accountants who understand small business dynamics can guide better.

c) Compliance and incentive navigation

India has many regimes of compliance: GST, income tax, TDS, ROC filings, MSME/startup incentives. Gujarati accountants help startups navigate these, avoid penalties, and claim benefits. Given Gujarat’s state incentives for startups, local accountants have on-ground experience.

d) Investor readiness and valuation support

As startups scale and look for funding, they need clean books, transparent financials, audits, and credible financial projections. Gujarati accounting firms offering startup-advisory services (accounting + tax + business consulting) help put the startup in shape for investors. For example, services for valuation advice, start-up accounting packages are now available in Gujarat.

e) Scale-up support, auditing, exit readiness

When a startup grows, becomes a scale-up or looks at M&A/exit, the requirements become heavier: audits, internal controls, reporting to investors, etc. Having a trusted regional accountant helps manage this transition smoothly.

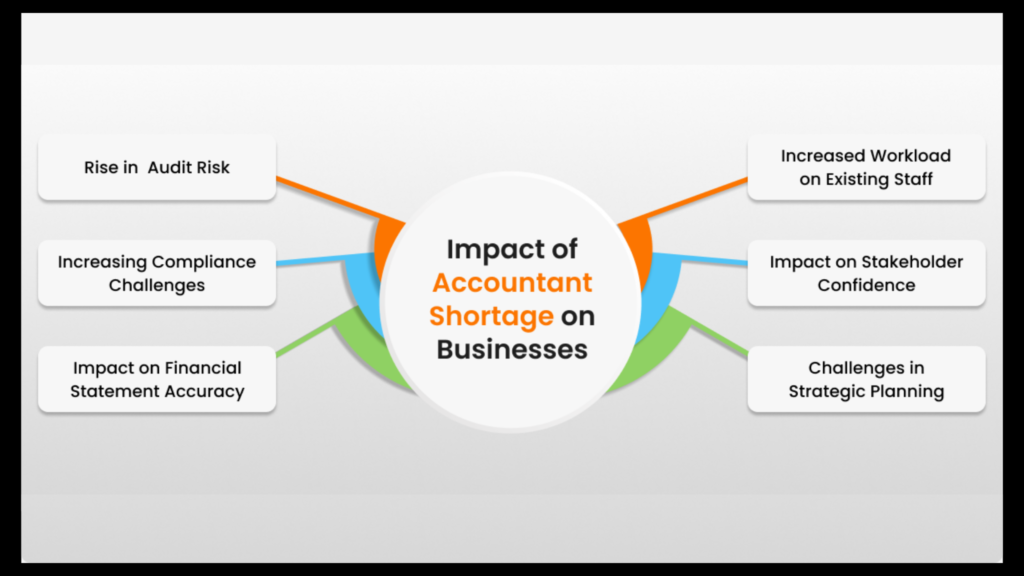

Challenges to overcome

Of course, the role of accountants is not without challenges. Some of the issues include:

- Startups sometimes treat accounting as a back-office burden rather than a strategic partner. Unless accountants are brought in early, they may merely file returns rather than add strategic value.

- Regional accounting firms may lack exposure to highly innovative business models (for example, deep-tech, SaaS, and global governance) that some startups follow. Bridging this gap is important.

- There is the question of talent and scaling: as a startup grows globally, it may require multinational financial expertise, which may exceed regional firms’ capacity unless they scale accordingly.

Why founders should engage good regional accountants early

From the perspective of a startup founder, engaging a competent accountant early on (especially a regional one familiar with the Gujarat business/start-up ecosystem) is a smart move. Here’s why:

- It lets you focus on product/market and customer growth, while leaving the financial foundations in capable hands.

- It helps avoid costly mistakes later (penalties, non-compliance, poor cash flow).

- It makes the company investor-ready quicker.

- It provides better strategic advice (for example, understanding which state incentives to tap, choosing entity type, and managing burn-rate).

- It builds a trusted partnership: as the startup grows, you need somebody you trust who knows your business.

Final thoughts

Gujarati accountants may not be the ones creating the next big startup, but they make sure every business starts on a strong base. Their local knowledge, business sense, and cost-friendly services help startups grow with confidence.

Founders who work with them early can manage money better, avoid mistakes, and focus on building their ideas. Behind many successful startups, there’s a quiet accountant making sure everything runs smoothly and every number adds up right.

Stay connected with Gujpreneur for more inspiration and updates from the world of entrepreneurs!